Almost all comic book fans can't help but compare the two heavyweights of the comic publishing world: DC and Marvel. YouTubers and bloggers constantly compare the MCU vs. the DCU; the Avengers vs. the Justice League; Spider-Man or Superman. Comic book investors also ask: is it better to invest in Marvel or DC?

The data contained in GoCollect's Silver Age CPI answers that question definitively (at least in my mind): it's better to invest in DC if you're a long-term investor.

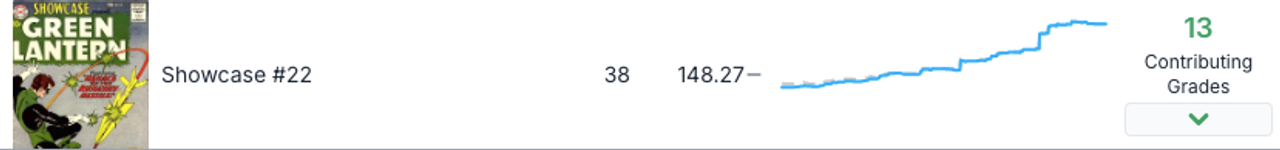

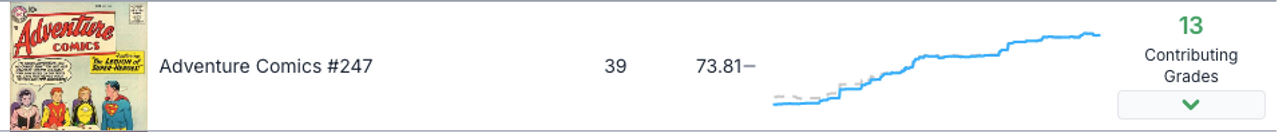

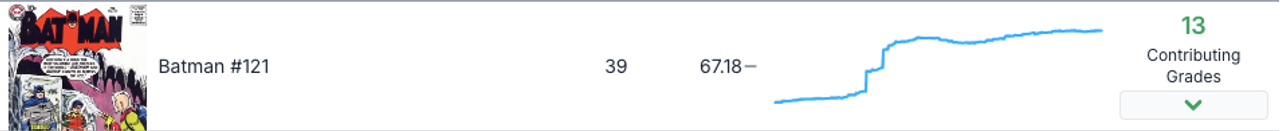

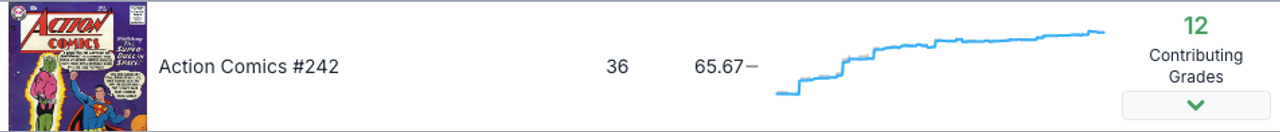

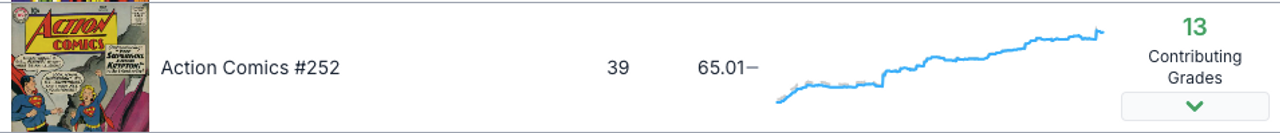

You can quickly scroll through GoCollect's Silver Age CPI to see that DC key issues from the Silver Age have produced a better ROI over the long-term. That's easy enough to see on your own, but let's take a look at several examples. Below you'll see the ten-year sales trajectories of Showcase #22 (1st appearance of Hal Jordan); Adventure Comics #247 (1st appearance of the Legion of Super Heroes); Batman #121 (1st appearance of Mr. Freeze); Action Comics #242 (1st appearance of Braniac); and Action Comics #252 (1st appearance of Supergirl).

All of the issues above are increasing in value steadily over time. Most noticeably, you don't see the volatility in sales prices that you see with most Marvel key issues; i.e., the effects of the comic boom in 2021 and the subsequent bear market. These DC issues above just keep climbing in value in a pretty steady and predictable manner.

Now let's take a look at five Silver Age Marvel issues that are also included in the index: (1) Daredevil #7 (1st appearance of Daredevil's red costume); (2) Marvel Super-Heroes #18 (1st appearance of the Guardians of the Galaxy); (3) Captain America #117 (1st appearance of Sam Wilson); (4) Thor #165 (1st appearance of Him (i.e., Adam Warlock); and Marvel Super-Heroes #13 (1st appearance of Carol Danvers).

The contrast in the sales values above in comparison to the DC issues is pretty stark. You can see the profound impact the comic boom had upon the Marvel issues and how much they have declined in value during the past two years. Some are even worth less today than they were ten years ago (to me, that is a big over-correction though). Strange Tales #110 (1st appearance of Doctor Strange) also falls into this category.

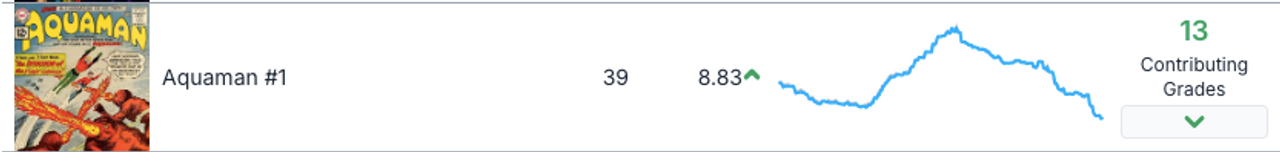

There are, of course, several exceptions. Fantastic Four #5 (1st appearance of Doctor Doom), Tales to Astonish #27 (1st appearance of Hank Pym), and Amazing Spider-Man #2 (1st appearance of the Vulture) all compare favorably in terms of ROI to DC Silver Age keys that are included in the Index. On the DC side, Aquaman #1 has a sales history that looks more like a Marvel book if you view the CPI with the five-year view:

Aquaman #1, across 13 different CGC grades, has lost about 15% of its value since September 2019. Personally, this book looks like it may have over-corrected to me.

The quantitative data clearly shows that the ROI for Silver Age DC key issues is generally higher than it is for Marvel keys from the same period of time. The quantitative, however, doesn't provide us a qualitative analysis; in other words, why do investors continue to buy DC key issues at increasingly higher values, but sell Marvel issues at lower prices? Although it's impossible to know for certain, but appears likely that the popularity of the MCU may have created a bubble for MCU key issues that popped in 2022.